WELCOME!

Rebecca Seeley Harris LLB (Hons) LLM MSc is an award winning independent expert in employment status including IR35, off-payroll working (OPW), self-employment, and other non-permanent roles.

She is considered to be the leading authority on employment status, IR35 and Off-payroll Working in the UK. She has been specialising in ’employment status’ for over 25 years since the inception of the tax initiative IR35. She is also the author of the Employment Status Roadmap.

Rebecca works with clients to help them understand the position mainly under the Off-payroll Working rules sometimes known as IR35. She also advises on other tax legislation that applies to working with the self-employed, limb ‘b’ workers, agency workers, CIS and Personal Service Companies (PSCs).

As Seen in…

Employment Status

Rebecca specialises in the law relating to working with a non-standard workforce, including amongst others the self-employed, sub-contractors, consultants, personal service companies, limb ‘b’ workers, LLP partners and IR35.

She has specialist knowledge in the university sector, executive coaching and leadership companies, aviation, virtual call centres, urgent healthcare and the care sector and recruitment agencies and businesses and in the construction industry, amongst others.

Public Policy

Rebecca was seconded to the Office of Tax Simplification, an independent body of HM Treasury, reviewing tax policy for the self-employed and small business.

Rebecca contributed to amongst others the Employment Status Review (2015), Review of Small Business Taxation (2016), a Focus paper on the Gig Economy (2017), and a Focus paper on SEPA (2016).

Rebecca can help you in responding to government consultations, producing ‘thought pieces’ or articles, or whitepapers.

Employed or self-employed?

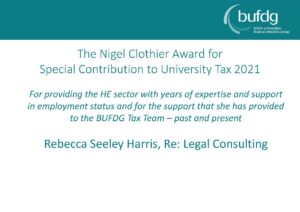

AWARDS

TESTIMONIALS

“

“Thank you for the great job you’ve done for the Office of Tax Simplification…I am told that your knowledge of employment issues and your ability to unpick the most technical aspects of legislation has been very valuable for the OTS…as has been you hard work in developing the OTS response to the issues faced in the gig economy.”

Philip Hammond, Chancellor of the Exchequer (2019)

“

“Thank you for the great job you have done for the Office of Tax Simplification and for all the support you have given to John Whiting and Jeremy Sherwood on the employment status review. I am told that your expert legal knowledge and experience has been really valuable for the office, as has been your skill in helping to put together the very impressive final report.”